All Categories

Featured

Table of Contents

Term life insurance coverage might be much better than home mortgage life insurance policy as it can cover mortgages and other expenditures. Compare life insurance coverage online in minutes with Everyday Life Insurance Coverage. Mortgage life insurance policy, likewise recognized as, mortgage protection insurance coverage, is marketed to home owners as a way to pay off their home mortgage in instance of fatality.

It sounds great, it may be much better to obtain a term life plan with a big fatality benefit that can cover your home loan for your beneficiary. Home mortgage life insurance coverage pays the rest of your home mortgage if you die during your term. "Mortgage security insurance is a method to speak about insurance coverage without mentioning passing away," claims Mark Williams, CEO of Brokers International.

Unlike a traditional term life insurance coverage policy that has the exact same costs, it's prices and the death benefit commonly reduce as your home mortgage lowers. This insurance coverage is often puzzled with exclusive home loan insurance, however they are extremely different principles. mortgage protect canada. If you have a home mortgage and your deposit is less than the ordinary 20%, your lender will certainly need home loan insurance to protect them in case you back-pedal your home mortgage repayments

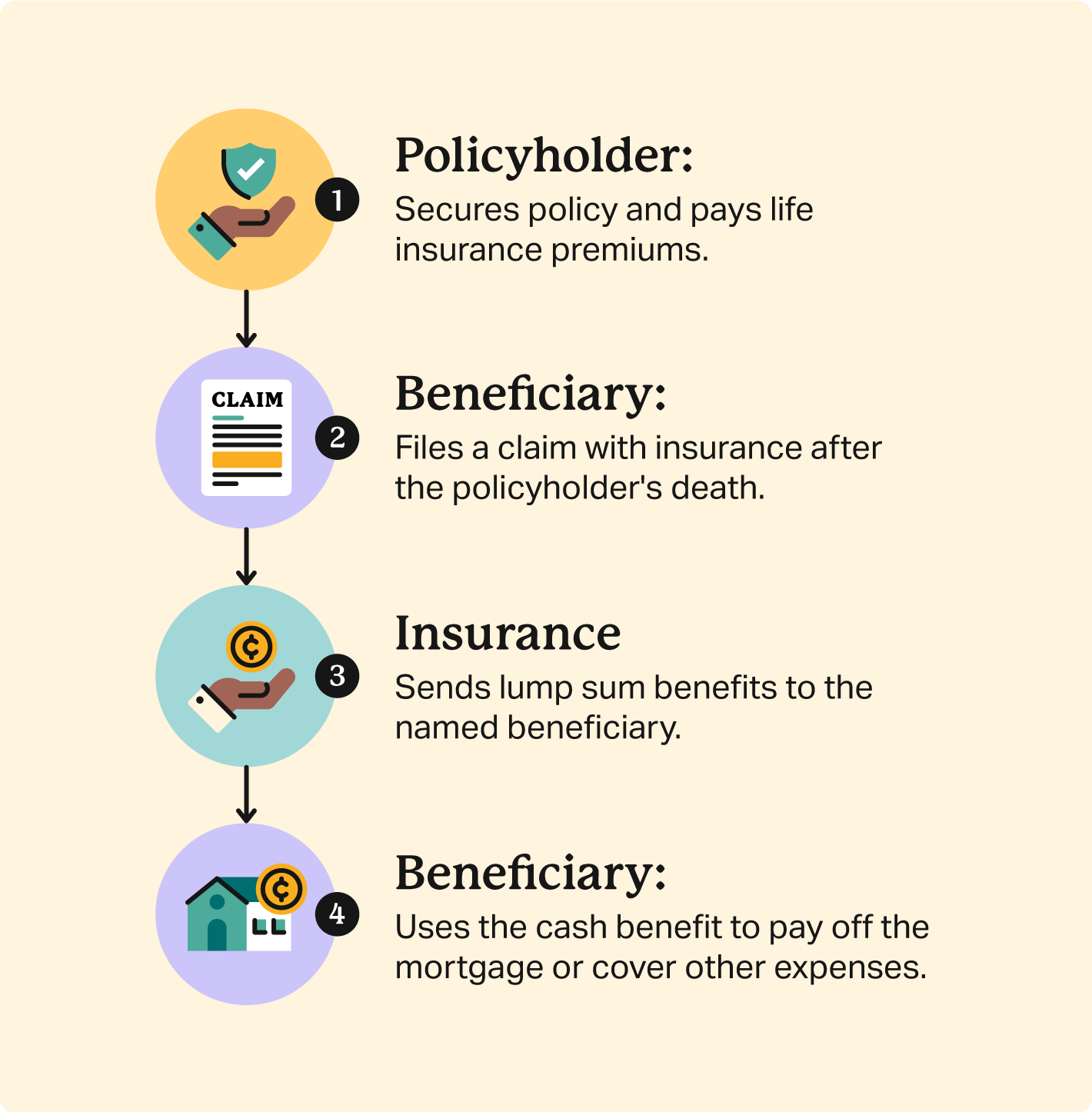

Williams said an individual can call a partner as the beneficiary on a mortgage security insurance coverage policy. The spouse will get the cash and can pick whether to settle the home mortgage or market your house. If a person has mortgage life insurance policy and a term life plan with the partner as the recipient on both, after that it can be a dual windfall.

Reducing term insurance coverage is the much more typical kind of mortgage life insurance policy. With this policy, your insurance costs and coverages decrease as your home loan quantity reduces. Level term insurance provides a set survivor benefit with the duration of your home loan. This type of home mortgage life insurance policy would certainly appropriate for an insurance policy holder with an interest-only mortgage where the consumer only pays the rate of interest for a specific period of time.

Life Of A Mortgage

Home mortgage life insurance policy likewise requires no medical examinations or waiting periods. If you die with an exceptional mortgage, mortgage life insurance pays the remainder of the loan straight to the lender. Subsequently, your liked ones don't need to handle the economic problem of paying off the mortgage alone and can focus on grieving your loss.

Your home loan life insurance policy plan is based on your mortgage amount, so the information will vary relying on the expense of your home lending. Its prices reduce as your mortgage lowers, but premiums are normally much more expensive than a typical term life plan - what is mpi insurance. When selecting your survivor benefit amount for term life insurance coverage, the guideline is to select 10 times your annual income to cover the mortgage, education for dependents, and other prices if you die

Your home loan life insurance plan ends when your home mortgage is paid off. If you pay off your home loan before you die, you'll be left without a fatality benefitunless you have various other life insurance coverage.

Insurance Policy On Home Loan

Both most common permanent life insurance policy plans are whole life and global life insurance. With a whole life policy, you pay a fixed costs for an ensured fatality advantage. The policy's cash value additionally expands at a set rate of interest. On the other hand, an universal life plan enables you to change when and just how much you pay in premiums, in turn changing your coverage.

Home mortgage life insurance may be a good option for home owners with health and wellness problems, as this protection gives immediate coverage without the requirement for a medical examination. Traditional life insurance may be the ideal choice for a lot of people as it can cover your home mortgage and your various other economic commitments. And also, it tends to be cheaper.

With reducing term insurance, your coverage lowers as your home mortgage decreases. No, lenders do not need home mortgage life insurance.

Mortgage Life Insurance Meaning

Yes. One perk of home loan life insurance coverage over a conventional term plan is that it commonly does not need a medical examination. Homeowners with pre-existing problems normally certify for this protection, however it's crucial to inspect with the plan issuer to validate any exclusions or restrictions. Ronda Lee is an insurance policy expert covering life, vehicle, house owners, and occupants insurance for consumers.

ExperienceAlani is a previous insurance policy fellow on the Personal Finance Insider group. She's examined life insurance policy and animal insurance provider and has composed countless explainers on traveling insurance, credit, financial obligation, and home insurance. She is enthusiastic about debunking the complexities of insurance and various other individual financing subjects to ensure that visitors have the information they require to make the very best money choices.

When you get a mortgage to acquire your home, you will usually need to secure home loan security insurance. This is a particular kind of life assurance that is secured for the term of the home loan. It repays the mortgage if you, or somebody you have the home mortgage with, dies.The lender is legitimately needed to make certain that you have home mortgage protection insurance prior to offering you a mortgage.

Mortgage Reducing Term Assurance

If you die without home mortgage insurance policy security, there will certainly be no insurance coverage to pay off the home mortgage. This suggests that the joint proprietor or your recipients will certainly need to continue settling the home loan. The need to secure home mortgage protection and the exceptions to this are set-out in Area 126 of the Non-mortgage Consumer Debt Act 1995.

You can obtain: Lowering term cover: The quantity that this policy covers decreases as you pay off your mortgage and the policy finishes when the mortgage is paid off. Your premium does not change, although the degree of cover decreases. This is one of the most usual and least expensive kind of home mortgage protection.

If you die prior to your home mortgage is paid off, the insurance coverage firm will certainly pay out the initial quantity you were insured for. This will certainly settle the home mortgage and any staying balance will certainly most likely to your estate.: You can add severe disease cover to your mortgage insurance coverage. This means your home mortgage will certainly be repaid if you are identified with and recuperate from a major ailment that is covered by your policy.

This is more pricey than various other types of cover. Life insurance policy cover: You can make use of an existing life insurance coverage plan as home mortgage defense insurance. You can just do this if the life insurance coverage plan gives enough cover and is not designated to cover one more lending or mortgage. Home loan repayment security insurance policy is a kind of payment protection insurance policy.

Where Do I Get Mortgage Insurance

This sort of insurance policy is typically optional and will commonly cover repayments for twelve month - insurance protections loans. You should consult your home mortgage lender, insurance coverage broker or insurance coverage business if you doubt regarding whether you have mortgage repayment security insurance policy. You should likewise inspect precisely what it covers and ensure that it fits your situation

With a home mortgage life insurance plan, your recipient is your mortgage loan provider. This means that the cash from the advantage payment goes straight to your home mortgage loan provider.

Mortgage Life Protection

Obtaining a mortgage is one of the largest duties that adults face. Falling behind on home mortgage payments can result in paying even more passion costs, late fees, foreclosure proceedings and even shedding your home. Home loan security insurance policy (MPI) is one way to safeguard your family members and investment in case the unimaginable occurs.

It is particularly helpful to individuals with costly home loans that their dependents could not cover if they died. The crucial difference between mortgage protection insurance (MPI) and life insurance coverage depends on their insurance coverage and flexibility. MPI is particularly designed to repay your home loan balance straight to the loan provider if you pass away, while life insurance policy gives a broader survivor benefit that your beneficiaries can use for any kind of economic requirements, such as home loan payments, living expenses, and financial debt.

Latest Posts

No Life Insurance Burial

Final Expense Life Insurance Reviews

Seniors Funeral Services