All Categories

Featured

Table of Contents

- – What is Level Benefit Term Life Insurance? A B...

- – What is Term Life Insurance With Accelerated D...

- – What is What Does Level Term Life Insurance M...

- – What is Term Life Insurance For Seniors? An E...

- – All About Term Life Insurance Level Term Cov...

- – What is the Purpose of What Is A Level Term ...

If George is identified with a terminal health problem throughout the initial policy term, he probably will not be eligible to renew the plan when it expires. Some plans supply assured re-insurability (without evidence of insurability), however such features come at a higher price. There are several kinds of term life insurance policy.

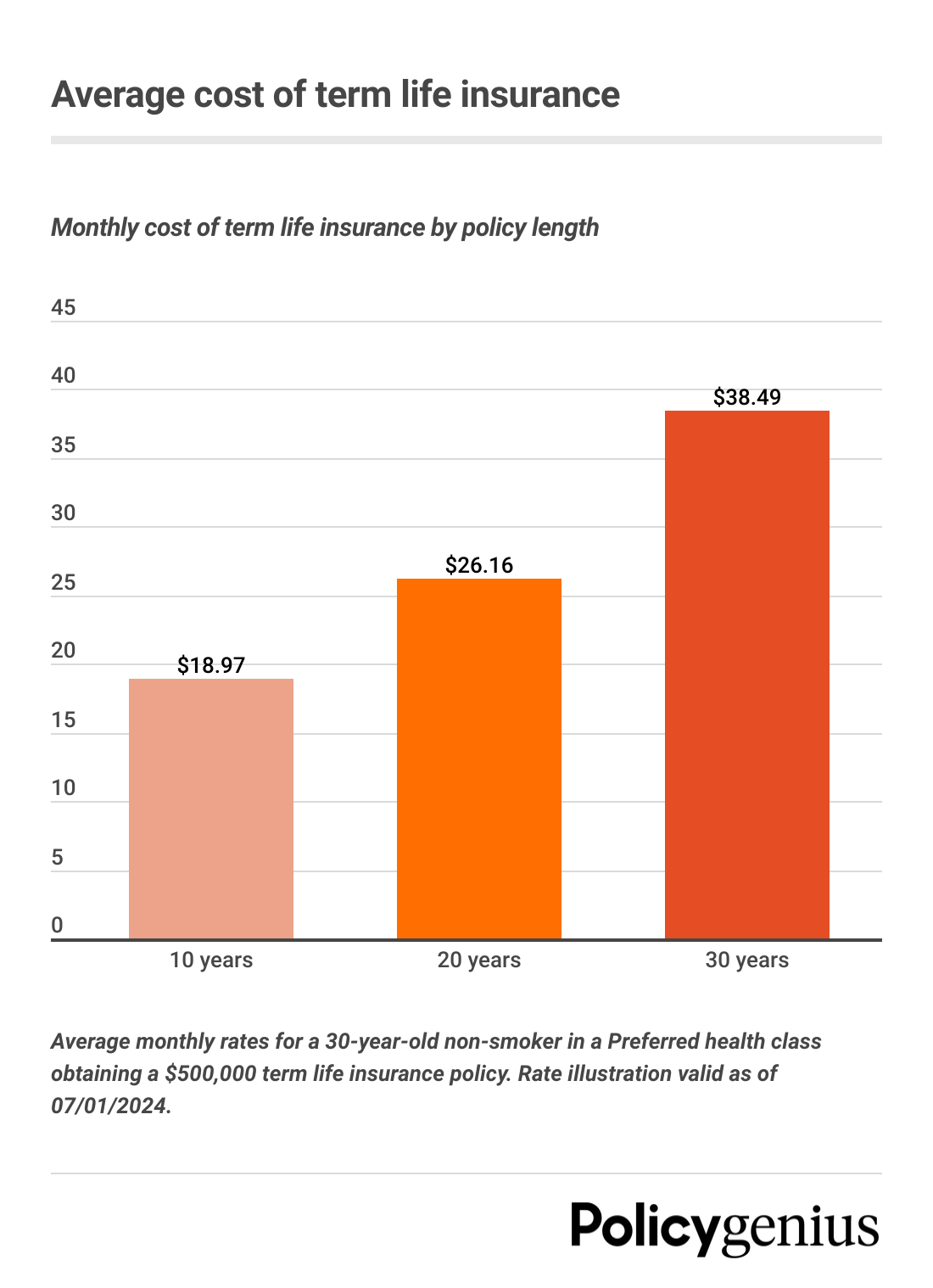

Normally, most business supply terms ranging from 10 to thirty years, although a few offer 35- and 40-year terms. Level-premium insurance policy has a set monthly repayment for the life of the policy. Most term life insurance policy has a level premium, and it's the type we've been referring to in a lot of this short article.

Term life insurance is eye-catching to youths with kids. Parents can get considerable coverage for an affordable, and if the insured dies while the policy is in result, the family can depend on the survivor benefit to replace lost earnings. These plans are likewise appropriate for people with growing households.

What is Level Benefit Term Life Insurance? A Beginner's Guide

Term life policies are excellent for individuals who want substantial protection at a reduced price. People that own entire life insurance policy pay much more in premiums for much less protection but have the safety of knowing they are safeguarded for life.

The conversion cyclist ought to permit you to convert to any kind of long-term policy the insurance provider provides without restrictions. The primary features of the biker are maintaining the initial health rating of the term plan upon conversion (even if you later on have health and wellness concerns or become uninsurable) and determining when and how much of the protection to convert.

Of training course, general costs will certainly enhance considerably since whole life insurance coverage is extra costly than term life insurance policy. Clinical problems that develop throughout the term life duration can not create costs to be increased.

What is Term Life Insurance With Accelerated Death Benefit and How Does It Work?

Term life insurance policy is a fairly cost-effective means to supply a swelling sum to your dependents if something takes place to you. It can be a good alternative if you are young and healthy and balanced and sustain a family members. Entire life insurance policy comes with substantially higher regular monthly costs. It is meant to supply protection for as lengthy as you live.

Insurance coverage firms established an optimum age restriction for term life insurance coverage policies. The premium likewise increases with age, so a person matured 60 or 70 will pay substantially even more than a person decades more youthful.

Term life is somewhat similar to cars and truck insurance. It's statistically not likely that you'll need it, and the costs are money away if you do not. If the worst occurs, your family members will receive the advantages.

What is What Does Level Term Life Insurance Mean? Learn the Basics?

For the most component, there are 2 sorts of life insurance policy plans - either term or long-term strategies or some combination of both. Life insurance providers supply various types of term plans and conventional life policies along with "passion delicate" items which have actually become extra widespread since the 1980's.

Term insurance policy gives security for a specified amount of time. This duration could be as short as one year or supply protection for a specific number of years such as 5, 10, two decades or to a specified age such as 80 or in many cases as much as the oldest age in the life insurance policy mortality.

What is Term Life Insurance For Seniors? An Essential Overview?

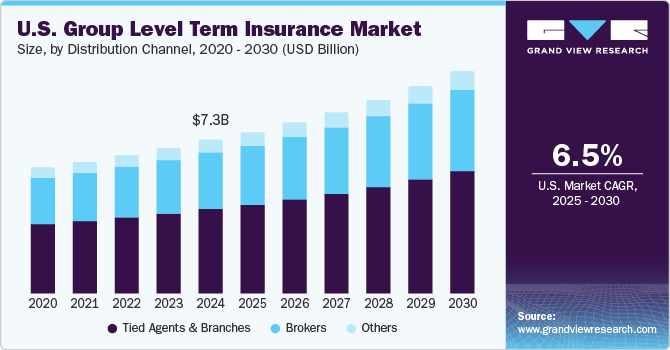

Presently term insurance policy rates are extremely competitive and amongst the cheapest historically experienced. It ought to be noted that it is a widely held idea that term insurance policy is the least costly pure life insurance coverage readily available. One requires to evaluate the policy terms thoroughly to choose which term life options appropriate to satisfy your particular circumstances.

With each brand-new term the premium is boosted. The right to restore the plan without proof of insurability is an important benefit to you. Or else, the risk you take is that your wellness might weaken and you may be incapable to acquire a policy at the same rates or perhaps whatsoever, leaving you and your recipients without insurance coverage.

You must exercise this alternative during the conversion duration. The length of the conversion duration will vary depending on the sort of term policy bought. If you convert within the recommended period, you are not required to offer any type of information concerning your wellness. The costs rate you pay on conversion is usually based on your "present acquired age", which is your age on the conversion day.

Under a degree term plan the face amount of the plan remains the exact same for the whole duration. With reducing term the face quantity minimizes over the period. The premium remains the very same each year. Frequently such plans are marketed as home loan protection with the amount of insurance coverage decreasing as the balance of the mortgage reduces.

Typically, insurers have not can alter premiums after the plan is sold. Since such plans might continue for years, insurance providers need to make use of conventional death, interest and expenditure rate price quotes in the costs computation. Adjustable costs insurance, however, permits insurers to use insurance at lower "existing" costs based upon much less conventional assumptions with the right to transform these costs in the future.

All About Term Life Insurance Level Term Coverage

While term insurance policy is made to provide security for a specified period, permanent insurance policy is made to give insurance coverage for your entire lifetime. To maintain the costs price degree, the premium at the younger ages goes beyond the actual expense of defense. This additional costs builds a book (cash worth) which helps spend for the plan in later years as the expense of protection surges above the premium.

Under some policies, premiums are called for to be spent for an established variety of years (Short Term Life Insurance). Under various other plans, costs are paid throughout the insurance policy holder's life time. The insurance provider spends the excess premium dollars This kind of policy, which is in some cases called cash value life insurance policy, creates a savings aspect. Cash money worths are essential to a permanent life insurance policy policy.

Sometimes, there is no correlation in between the size of the cash worth and the costs paid. It is the money value of the policy that can be accessed while the policyholder lives. The Commissioners 1980 Standard Ordinary Mortality (CSO) is the present table made use of in determining minimum nonforfeiture worths and plan gets for normal life insurance policy policies.

What is the Purpose of What Is A Level Term Life Insurance Policy?

Lots of permanent policies will certainly contain arrangements, which define these tax requirements. Conventional entire life plans are based upon long-lasting estimates of cost, rate of interest and death.

Table of Contents

- – What is Level Benefit Term Life Insurance? A B...

- – What is Term Life Insurance With Accelerated D...

- – What is What Does Level Term Life Insurance M...

- – What is Term Life Insurance For Seniors? An E...

- – All About Term Life Insurance Level Term Cov...

- – What is the Purpose of What Is A Level Term ...

Latest Posts

No Life Insurance Burial

Final Expense Life Insurance Reviews

Seniors Funeral Services

More

Latest Posts

No Life Insurance Burial

Final Expense Life Insurance Reviews

Seniors Funeral Services