All Categories

Featured

Table of Contents

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations (final expense plans with immediate coverage brokers recommend). Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow.

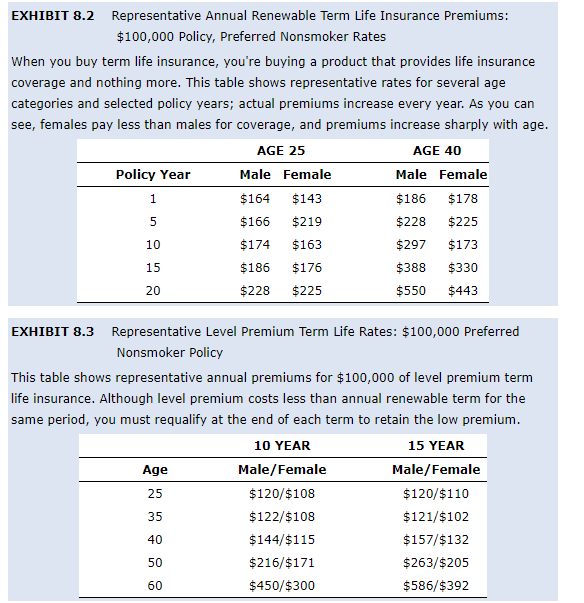

If you pick level term life insurance policy, you can allocate your premiums because they'll stay the exact same throughout your term. Plus, you'll know precisely how much of a death advantage your beneficiaries will certainly receive if you die, as this quantity won't change either. The prices for level term life insurance will rely on a number of variables, like your age, wellness standing, and the insurance provider you choose.

As soon as you go with the application and clinical exam, the life insurance coverage company will certainly examine your application. Upon authorization, you can pay your initial costs and sign any pertinent documents to ensure you're covered.

You can choose a 10, 20, or 30 year term and appreciate the included peace of mind you are worthy of. Functioning with an agent can help you locate a plan that functions ideal for your needs.

As you search for means to secure your economic future, you have actually most likely encountered a wide range of life insurance policy choices. direct term life insurance meaning. Selecting the ideal coverage is a huge decision. You desire to locate something that will certainly help support your liked ones or the causes vital to you if something occurs to you

Several people lean towards term life insurance coverage for its simpleness and cost-effectiveness. Level term insurance, nevertheless, is a kind of term life insurance policy that has constant repayments and a constant.

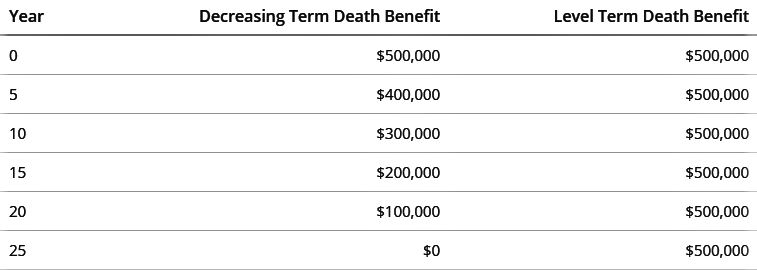

Proven Decreasing Term Life Insurance

Level term life insurance policy is a part of It's called "degree" since your premiums and the benefit to be paid to your enjoyed ones remain the very same throughout the contract. You won't see any modifications in cost or be left questioning its value. Some contracts, such as each year eco-friendly term, might be structured with costs that increase over time as the insured ages.

Dealt with death benefit. This is likewise set at the beginning, so you can recognize exactly what fatality benefit amount your can expect when you pass away, as long as you're covered and updated on costs.

You agree to a set costs and fatality advantage for the duration of the term. If you pass away while covered, your fatality benefit will be paid out to loved ones (as long as your premiums are up to date).

You might have the option to for an additional term or, most likely, restore it year to year. If your contract has a guaranteed renewability condition, you might not need to have a new medical examination to keep your protection going. Nevertheless, your costs are most likely to increase because they'll be based on your age at revival time (joint term life insurance).

With this alternative, you can that will last the remainder of your life. In this situation, again, you might not need to have any kind of new medical exams, however costs likely will rise as a result of your age and new coverage. what is direct term life insurance. Various companies supply numerous alternatives for conversion, be sure to recognize your choices prior to taking this action

Family Protection Joint Term Life Insurance

Speaking with a monetary expert likewise might aid you identify the path that straightens finest with your general technique. Many term life insurance is level term throughout of the contract duration, yet not all. Some term insurance coverage may feature a premium that boosts in time. With lowering term life insurance policy, your survivor benefit drops over time (this kind is often taken out to particularly cover a lasting debt you're repaying).

And if you're set up for sustainable term life, after that your premium likely will increase yearly. If you're discovering term life insurance policy and want to make certain uncomplicated and predictable economic protection for your household, degree term might be something to consider. Nevertheless, just like any kind of sort of insurance coverage, it might have some limitations that do not satisfy your needs.

Premium What Is Direct Term Life Insurance

Normally, term life insurance policy is more inexpensive than irreversible protection, so it's an affordable means to secure economic security. Versatility. At the end of your agreement's term, you have several choices to proceed or carry on from insurance coverage, often without needing a medical exam. If your budget plan or insurance coverage needs adjustment, death advantages can be reduced gradually and outcome in a lower costs.

Just like other sort of term life insurance policy, once the agreement finishes, you'll likely pay greater costs for insurance coverage since it will certainly recalculate at your current age and health and wellness. Fixed protection. Level term provides predictability. If your financial circumstance changes, you may not have the required insurance coverage and could have to acquire extra insurance.

But that does not indicate it's a fit for every person. As you're buying life insurance policy, right here are a couple of crucial variables to take into consideration: Budget plan. One of the benefits of level term insurance coverage is you understand the expense and the survivor benefit upfront, making it simpler to without fretting about rises with time.

Age and health and wellness. Normally, with life insurance, the much healthier and younger you are, the much more budget-friendly the insurance coverage. If you're young and healthy and balanced, it may be an enticing option to secure reduced costs currently. Financial obligation. Your dependents and financial responsibility play a role in identifying your coverage. If you have a young household, for example, degree term can help offer financial backing throughout vital years without spending for insurance coverage much longer than required.

1 All riders are subject to the terms of the cyclist. All motorcyclists may not be offered in all jurisdictions. Some states might vary the terms (what is voluntary term life insurance). There may be a surcharge connected with acquiring particular bikers. Some motorcyclists might not be readily available in combination with various other riders and/or policy features.

2 A conversion credit history is not offered for TermOne policies. 3 See Term Conversions section of the Term Collection 160 Product Overview for just how the term conversion credit score is determined. A conversion credit report is not readily available if costs or costs for the brand-new policy will certainly be waived under the regards to a cyclist providing disability waiver advantages.

Expert Increasing Term Life Insurance

Term Collection items are released by Equitable Financial Life Insurance Business (Equitable Financial) (NY, NY) and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Coverage Agency of California, LLC in CA; Equitable Network Insurance Policy Firm of Utah in UT; and Equitable Network of Puerto Rico, Inc. Term Life Insurance policy is a kind of life insurance coverage plan that covers the policyholder for a details quantity of time, which is recognized as the term. Terms normally range from 10 to 30 years and rise in 5-year increments, providing level term insurance policy.

Latest Posts

No Life Insurance Burial

Final Expense Life Insurance Reviews

Seniors Funeral Services